LHDN E-Invoice Integration: Effortless & Powerful Tax Compliance with Propkita

Table of Contents

LHDN E-Invoice Integration is now available directly on the Propkita platform! You can now generate e-Invoices that are officially validated by the Inland Revenue Board of Malaysia (LHDN) through your Propkita account. This highly anticipated feature is designed to simplify your tax management, enhance transaction transparency, and give you a strong advantage when handling audits, tax relief claims, or any other official financial matters.

What Does This Mean For You As a Propkita User

Starting today, every payment you make via the Propkita system will not only provide you with the usual digital receipt—you now have the option to apply for and receive an e-Invoice that is officially validated by LHDN.

This e-Invoice serves as an official document for tax relief claims, audit verification, and future tax-related references.

Key Benefits For You

Tax Matters Made Easy

Starting today, every payment you make via the Propkita system will not only provide you with the usual digital receipt—you now have the option to apply for and receive an e-Invoice that is officially validated by LHDN.

This e-Invoice serves as an official document for tax relief claims, audit verification, and future tax-related references.

Verified & Recognized

Your e-Invoice is authenticated by LHDN, complete with a Unique Identification Number (UIN) and official timestamp

Fully Digital Documentation

All processes are online—making it easy to access, store, and present your documents whenever needed.

Enhanced Confidence

Your receipt and e-Invoice now include a QR code for instant authenticity verification by any relevant party.

How to Obtain Your LHDN E-Invoice Through Propkita (Step by Step)

To take advantage of this new feature, simply follow these easy steps within the Propkita system:

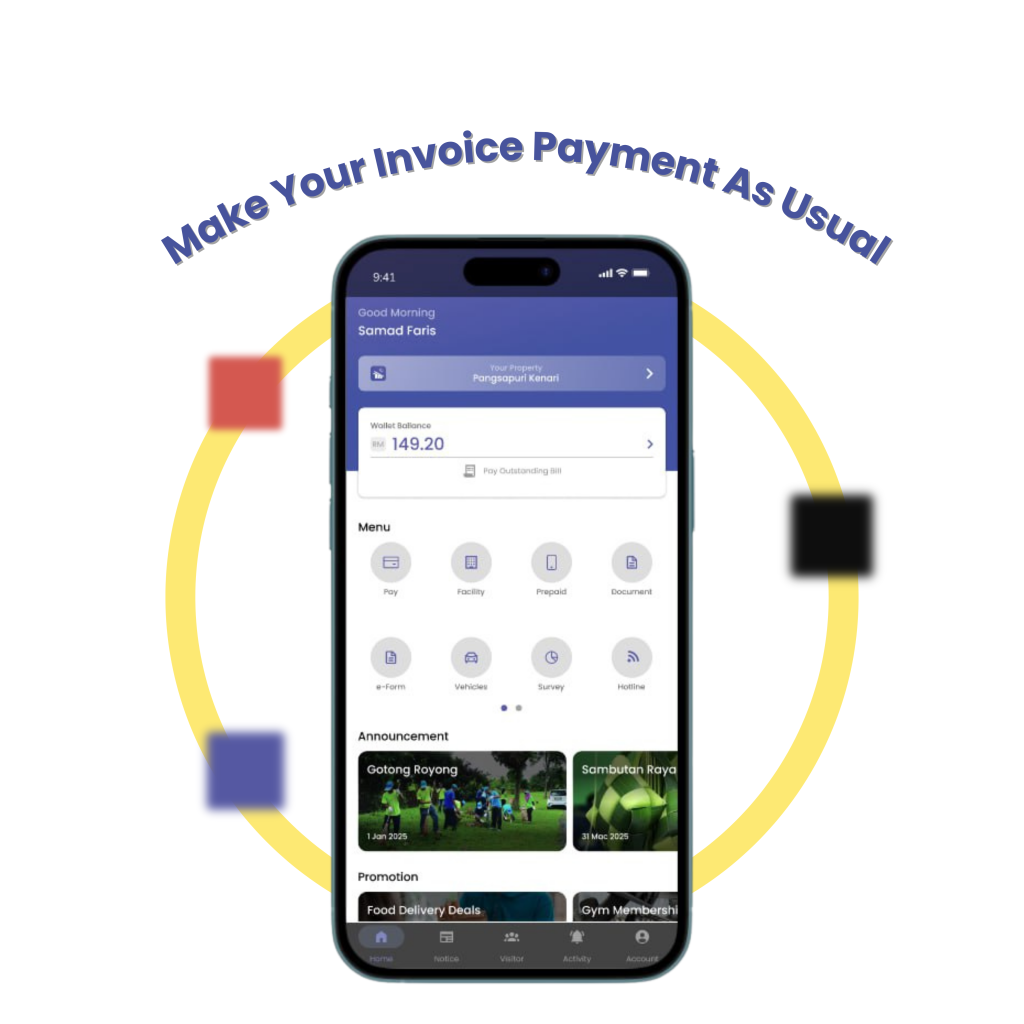

1. Make Your Invoice Payment As Usual

After logging in and making payment for any invoice or service in Propkita (via FPX, e-wallet, or other available methods), the system will automatically generate your digital receipt.

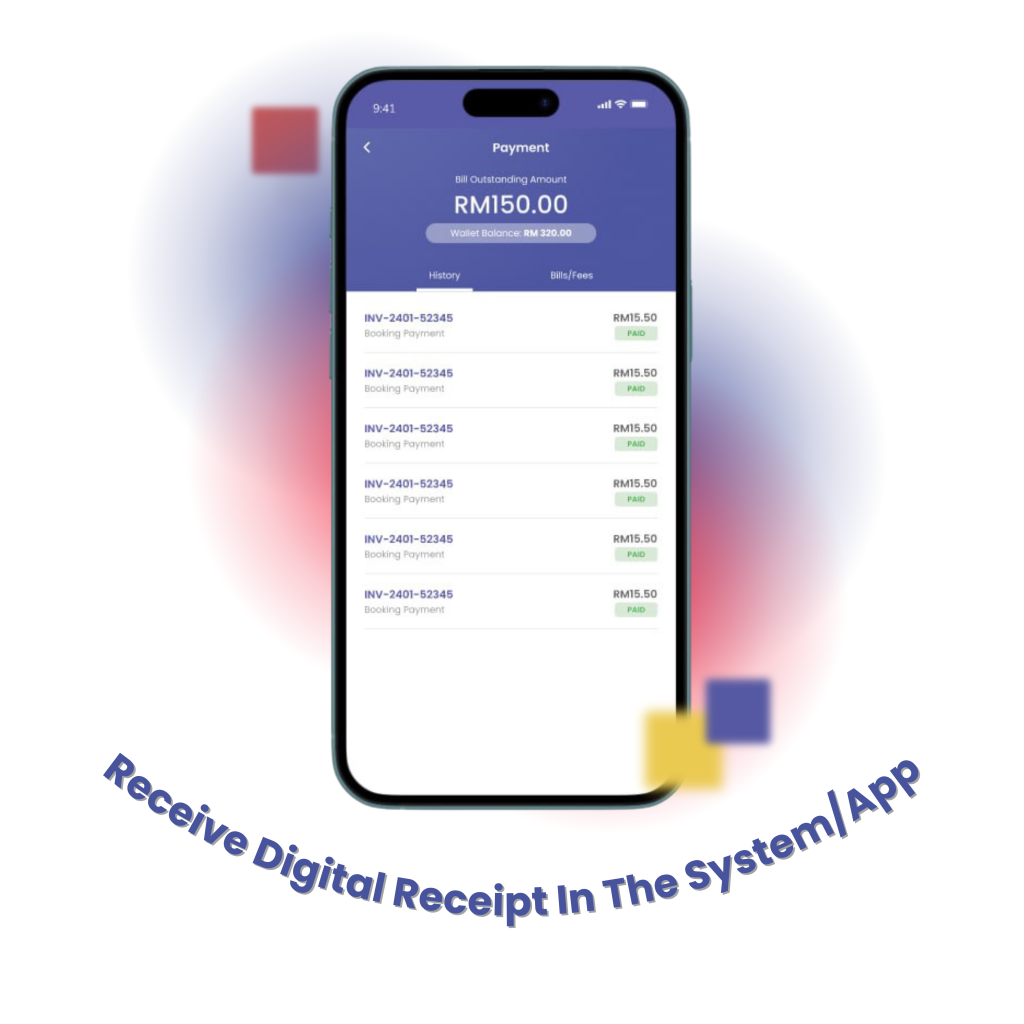

2. Receive Your Digital Receipt In The System/App

Your payment receipt will be available in your account. You can view or download it as before.

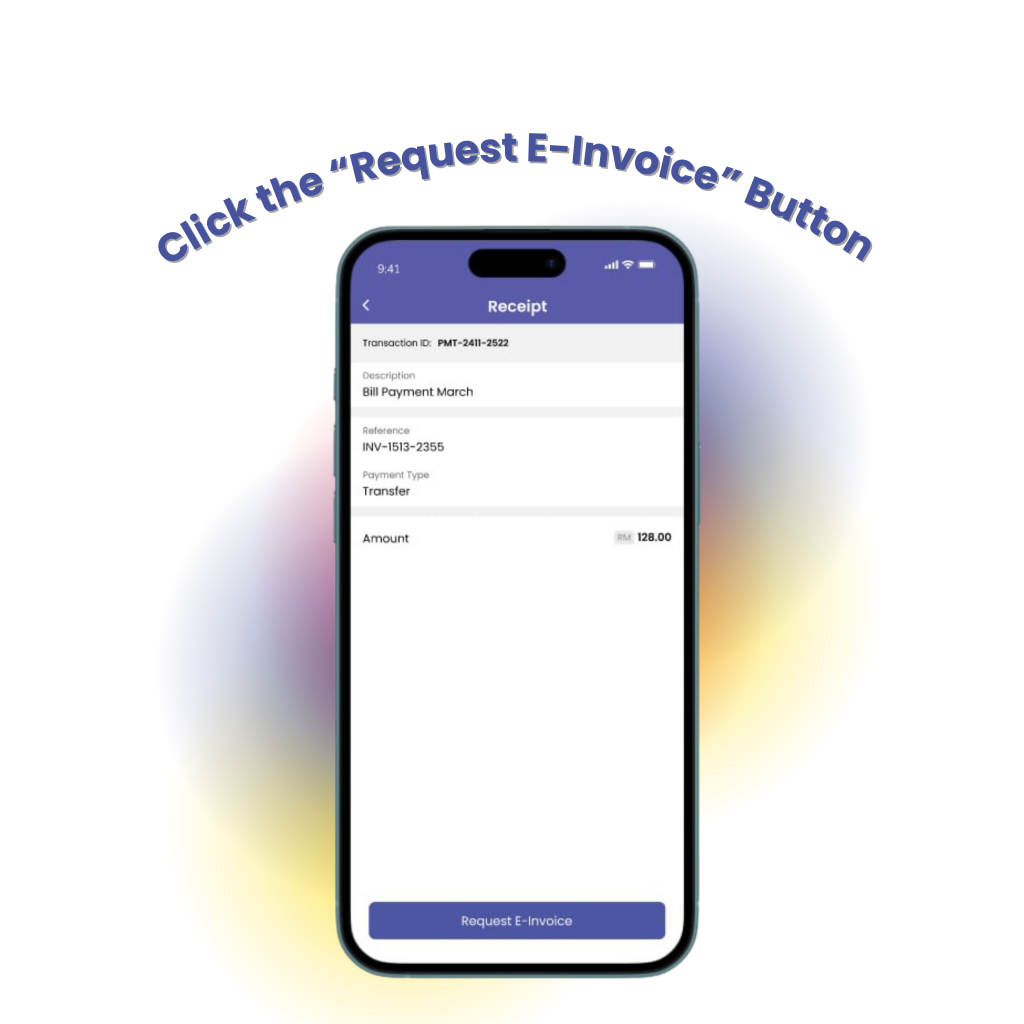

3. Click the “Request LHDN E-Invoice” Button on Your Receipt

On each digital receipt, you will find a dedicated button or QR code enabling you to request the official e-Invoice.

Click this button to start the application process.

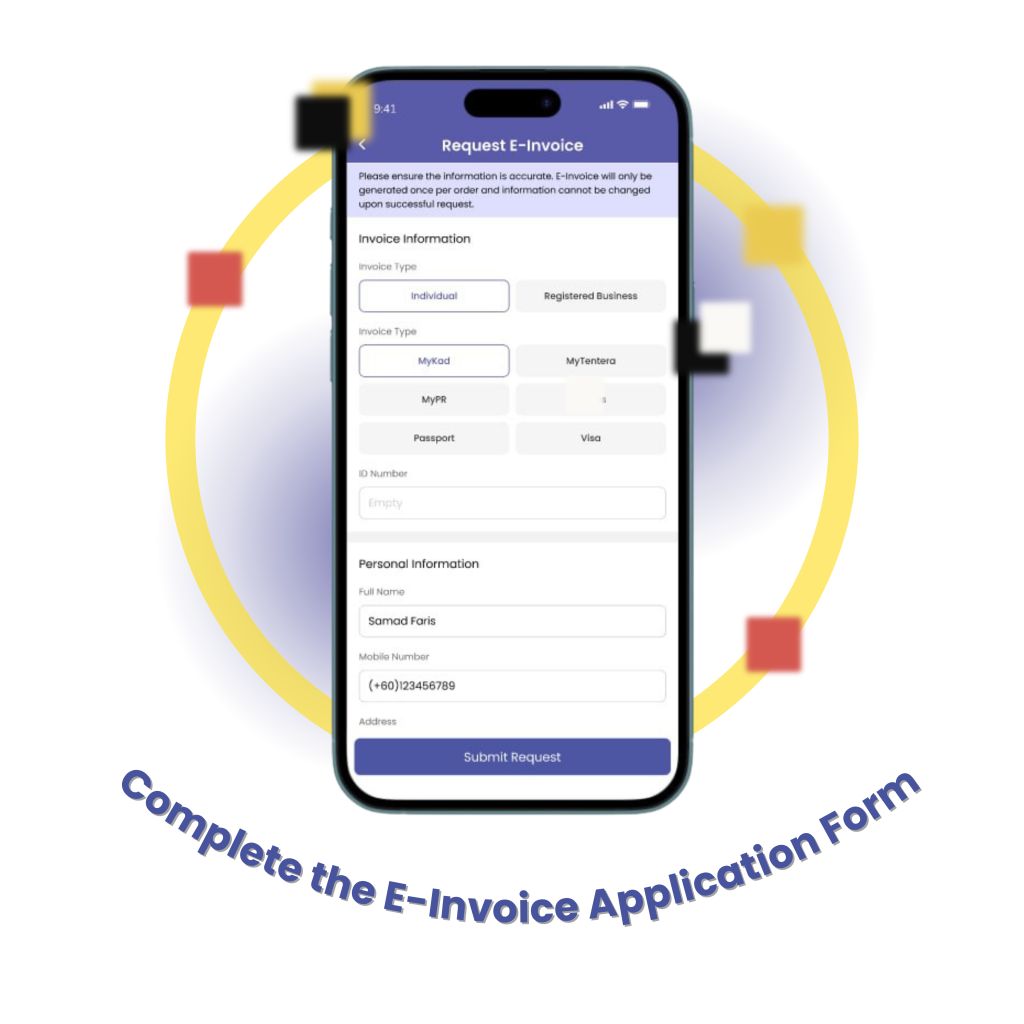

4. Complete the E-Invoice Application Form

The system will display a form for you to enter essential information such as:

- Select Invoice Type: Individual or Registered Business

- Choose identification document: MyKad, MyTentera, MyPR, MyKas, Passport, or Visa

- Enter ID Number

- Fill in full name, mobile number, and address

Please ensure all information entered is accurate to avoid your application being rejected.

5. System Will Validate Your Data

The system will check your data, and if all information is complete and valid, your application will be automatically submitted to the LHDN e-Invoice system.

6. E-Invoice Validated & Issued

Once validated by LHDN, the Propkita system will:

- Display a success notification

- Provide the complete e-Invoice with QR code and Unique Identification Number (UIN)

- Allow you to download, print, or save your digital e-Invoice for tax relief claims or audit purposes

Easy Steps to Get Your LHDN E-Invoice (With Pictures)

1. Make Your Invoice Payment As Usual

After logging in and making payment for any invoice or service in Propkita (via FPX, e-wallet, or other available methods), the system will automatically generate your digital receipt.

2. Receive Your Digital Receipt In The System/App

Your payment receipt will be available in your account. You can view or download it as before. Tap on any paid invoice to view detailed information and access your digital receipt.

From here, you can proceed to the next step to request your e-Invoice.

3. Click the “Request LHDN E-Invoice” Button on Your Receipt

After making a payment through the Propkita system, users will receive a digital receipt. This receipt will display all essential information, such as:

- Transaction ID

- Description (e.g., Bill Payment March)

- Reference No. (e.g., INV-1513-2355)

- Payment Type (Transfer/FPX/e-wallet)

- Payment Amount

4. Complete the E-Invoice Application Form

After clicking “Request E-Invoice,” users will be directed to a dedicated application form.

Required information:

- Select Invoice Type: Individual or Registered Business

- Choose identification document: MyKad, MyTentera, MyPR, MyKas, Passport, or Visa

- Enter ID Number

- Fill in full name, mobile number, and address

5. Receipt with E-Invoice QR Code

Once the e-Invoice applicaion has been processed and validated:

- The payment receipt will be updated with a QR code.

- This QR code is proof that your invoice has been validated by the LHDN system (with an official UIN & timestamp).

Users can share or download this QR code for record-keeping, tax claims, or audit purposes.

Why Should You Use the LHDN E-Invoice Feature?

- Tax Compliance: You are always prepared if documents are requested by LHDN.

- Easy Audit Process: No more searching for old receipts—everything is accessible and verifiable at any time.

- Save Time & Effort: All processes are fully digital with zero manual paperwork.

- Official Documentation: Safer and more secure for corporate dealings, loan applications, incentive claims, and more.

Quick FAQ

Yes! As long as your transaction and receipt exist in the system, you can request an e-Invoice anytime.

Once your application is submitted, your e-Invoice is usually generated and available within a few minutes. In rare cases, it may take up to 24 hours if further validation is required.

Yes, they are official documents recognized by LHDN for both company and individual tax purposes.